Once the IRS processes your extension, we will notify you of the filing status through email. > You can then review the Form summary and E-file it with the IRS. 2016 Business Tax Filers (Taxpayer) The Department of Finance offers electronic filing (e-filing) for General Corporate Tax (GCT), Business Corporation Tax (COR), Unincorporated Business Tax Partnership (UBTP), Unincorporated Business Tax Individual (UBTI), and NYC-1127 filers. Form 5452 for reporting nontaxable corporate distributions made to shareholders during calendar year 2015 should be filed by calendar-year corporations with income tax return. > You can choose to pay the balance due to the IRS using EFW, Check or Money Order. Title: Tax Bulletin 17-9 - 2016 Virginia Corporate Income Tax Returns Filed on Extension Author: Virginia Tax Subject: As a result of recent federal legislation and administrative action by the IRS, certain corporations have an additional filing extension for federal purposes, effective for returns filed for taxable years beginning after Dec. Last date for filing application (Form 7004) by calendar-year corporations for automatic six-month extension to file 2015 income tax return. > Enter the estimate of total income tax payment and balance due, if any. > Enter your Personal Details such as Name, SSN, and Address.

> Select the extension type you would like to file.

#Tax e file extension 2016 download

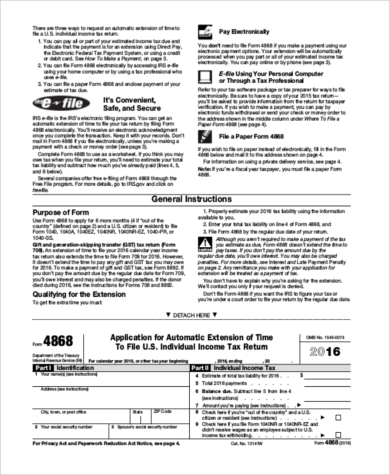

> Simply download our app and log in to your ExpressExtension account. Get started with ExpressExtension, an IRS-authorized e-file provider for IRS tax extension forms, and e-file your Form 4868 for an automatic extension of time to file your personal income tax return.ĮxpressExtension provides a user-friendly, step-by-step filing process that helps you to file tax extension Form 4868 in minutes with the convenience of our mobile app. Individual Income Tax Return, with only the name, address, and. However, if form 4868 gets rejected for any other reason, users have the option to correct and resubmit at no additional cost. To obtain an extension only for Wisconsin, you must attach a statement to your Wisconsin income tax return indicating you wish to take the federal Form 4868 extension provision or attach a copy of the federal Form 4868, Application for Automatic Extension of Time to File U.S.

#Tax e file extension 2016 full

In addition, ExpressExtension offers an Express Guarantee this tax season, meaning any user who files a Form 4868 and receives an IRS rejection stating duplicate filing will get a full refund. The IRS suggests individuals e-file their extension Form 4868 for both faster processing and instant approval. Form 4868 provides an automatic 6-month extension of time to file the 1040 income tax return with the IRS. Individuals that need more time to file their income tax returns can apply for an extension using Form 4868. individuals must file their income tax return 1040 with the IRS this year by May 17.

0 kommentar(er)

0 kommentar(er)